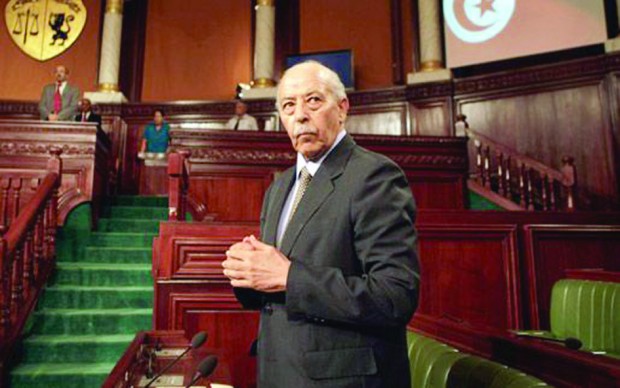

File photo of Tunisian central bank Governor Chadli Ayari. (Asharq Al-Awsat)

London, Asharq Al-Awsat—In an exclusive interview with Asharq Al-Awsat against the backdrop of the G8 Deauville Partnership Investment conference in London, Tunisian central bank Governor Chadli Ayari discussed the bleak economic situation in the country post-Arab Spring, blaming the political stalemate for the country’s financial woes.

Chadli Ayari highlighted the effect that Tunisia’s political crisis is having on the economy, saying that the country could be facing a “disastrous situation” if this is not resolved by the end of the year. The central bank governor called for austerity measures, saying that the country will likely not have the resources to increase wages in 2014.

Asharq Al-Awsat: During your visit to London you attended the G8 Deauville Partnership Investment conference held by the British foreign ministry. What is the most important work being done by this conference?

Chadli Ayari: The conference is part of the G8 summit. It is important as it includes the largest economies in the world and they have embraced the so-called Arab Spring nations.

Q: What do you mean by “embracing” these nations?

I mean that they will help find solutions to restart economic development in those countries. They’ve tried to widened their scope. Their projects were limited to Tunisia, Libya, Yemen and Egypt of course. Now they’ve included Morocco and Jordan, given that those countries are also facing transitional periods. They believe these nations need support from Western nations. So the Deauville Partnership was established through an agreement that was signed in Deauville, France, more than two years ago to support the Arab Spring nations.

Q: Two years ago Britain and the West were generally more excited about helping the Arab Spring, states but now it seems there is some apathy. Has the West’s willingness to support the Arab Spring nations really changed?

I won’t say that the the West is apprehensive, but they’re certainly questioning things. They took a particular course of action. Although they didn’t favor the Islamists, they worked with them in the hopes of advancing the so-called moderate Islam solution. They were hoping for stability and democracy, but developments in Tunisia, Libya and Egypt contradicted their expectations. Their political calculations were disappointed as developments took an unexpected turn. For instance, they expected that the return of the Islamists would be a return of moderate and democratic Islam. However, they saw that the removal of the dictators led to Islamic extremism and a form of terrorism. This was not the scenario they wanted. They found themselves dealing with havens for terrorism. Now they have to address a variable they had not accounted for: the threat of terrorism. In Syria, for example, Islamic extremism has taken over the opposition threatening the Afghanization of Syria.

Q: Are the post-revolution nations facing the same economic difficulties?

No. Everyone should know that each nation is facing its own particular situation. What is happening in Egypt is different than what is happening in Libya. Every nation is different, and addressing all of problems in the same way would be a mistake. The “Arab Spring” is a label for many countries facing different problems.

Q: Experts and the opposition in Tunisia has condemned the manner in which the financial and economic situation has been administrated, saying this has led to a reliance on loans.

Whomever criticizes us should first know the situation we’re dealing with. Three-quarters of those criticizing us don’t know the actual state of the country. We’ve been financially weak for some time. You can’t create wealth without investment. If you want investment you have to look for sources of funding and that basically depends on national savings, and our domestic resources, and the difference between the investment that we need and the resources we have available. Anyone who criticizes us on the the subject of loans is mistaken.

Today, Tunisia’s debts are between 45 and 46 percent of our production. Compared to other countries that is acceptable and controllable. The important thing in accepting loans is how to use the funds. If I wanted to take loans to fund everyday consumption that would be a problem. But taking loans to create industrial or agricultural growth is not a problem at all. In the future you’ll gain revenue from what you’ve created. The issue is misuse.

Q: Is it true that all of the loans taken out by Tunisia will be spent on wages because the government cannot support the wages of its employees?

No, that is incorrect. I won’t hide that fact that we wanted the bulk of the loans to go towards development alone. But that didn’t happen because of the pressure of wages and oil and food subsidies, which amount to TND 3–4 billion. Oil prices are steadily increasing and gas is an important factor. This puts pressure on all resources and draws on hard currency. It is like a cancer.

Q: Did you not find cooperation from within the government regarding the implementation of this plan?

Right now, we’re repeating the same rhetoric with every budget. We warn the government that the budget after the revolution must be an austerity budget. It is impossible to have a revolution it its early years without a period of austerity.

Q: What answer have you received from the government?

So far, the austerity plan is not included in the Tunisian budget. And we’re paying the price for it. We’re discussing the 2014 budget right now and it appears that for the first time the government is heading towards limiting expenses. But we can’t continue like this. Austerity in consumption particularly. I don’t imagine that we have the resources to increase wages in 2014.

Q: Given the transitional circumstances, the government could believe that imposing austerity measures would put them in danger of being removed from power. Doesn’t this therefore place them in a predicament?

Of course. I totally agree. That’s correct. But our roles are different. My role now as the central bank governor is to set of the alarm, given that I am independent. I’ve said this before. We’ve said and repeated that the financial and economic situation has reached a critical phase. When I took the position as governor of the central bank 13 months ago, I was more optimistic. I wasn’t unduly optimistic. I was talking about the possible return to economic growth. but I began to doubt that last February after the assassination of Chokri Belaid. Even with those difficulties, I was still optimistic.

But the situation has gotten worse. After the July 25 assassination of Mohammed Brahmi things changed with the calls for the fall of the government. A week ago I met with President Marzouki and I told him that if the political situation in the country does not stabilize the economy will suffer, because the economy is a hostage to politics. We have the capability to restart the economy and we have help from other nations. We, as experts, can create wealth in Tunisia. But, I’ll give you a simple example: the mine strikes. I can’t put together a plan because I don’t know what my revenue from phosphates will be, for example. That is connected to the policies of the Tunisian General Labor Union [the largest union in Tunisia]. I can’t present certain guarantees for the economy. It’s not that I’m not able to. Circumstances won’t allow it. We have delegations of foreign investors that have stopped coming. We asked them not to come because we’re wondering, who will they meet with? And they’re asking: Do you have a political plan? The answer is clear, we don’t.

Q: Do you see any hopes for a political solution on the horizon in Tunisia, especially since, as you said, the economy is a hostage to politics?

We’ve come to the end of the road. The transitional period is almost over and there has been a significant shift. Now, everyone wants the transitional period to end. This includes the people and the opposition. There has been a shift in the left, right and center. Everyone wants stability. But there isn’t a shared national consciousness. Everyone wants to get into a position and hold onto it. There are greater interests that aren’t being considered.

The focus on development isn’t there. All the thinking is in politics, and the economy is put to the side. There is a sense that the economy isn’t a priority.

Q: Do you think that continued economic decline could bring down the current government in Tunisia?

I’ll say that if there isn’t an awareness of the need to save the economy from collapse by the end of 2013, Tunisia could reach a disastrous state. We’ve put off dealing with this. I’ve said for months that every day the economic solution is absent is a political disaster. We’re still holding it together to some extent. We are in a very critical phase. I don’t have a political solution as I am independent.

I will tell politicians this: You are spending more than your resources allow. The cake you want to divide amongst yourselves won’t be there. What will you give out? Poverty? If democracy meant spreading poverty then that’s it, there is no hope.

Q: How will the Tunisian dinar remained stable despite all of these problems?

The dinar stores the country’s problems. Currency is confidence. You don’t have any other power. Currently, it is falling compared to strong currencies like the euro and the dollar. Since the revolution the dinar has dropped between 10 and 15 percent of its value, which reflects the decline in the Tunisian economy. Currency has declined due to the low exports and a drop in production. Europe is in a crisis which negatively affects the dinar. What do we do when we see it declining? We buy dinar, injecting hard currency. Observers could think about doubting the dinar and the economy. Currency is a coward, and we’re afraid to venture into it. The Tunisian exporter should place the currency in his account to use it as a resource.

Q: How has currency smuggling from Libya affected things?

Since the Libyan revolution we’ve seen the export and introduction of billions of dollars and securities in the parallel market on the border. The introduction of an unmonitored currency has disrupted our calculations. If you go to the regions near the borders, currency is sold like bread. But, thankfully, they’re selling it at near-official prices. Every week we see reports that they’ve stopped someone carrying more than EUR 100,000 into Tunisia. We’ve seen lists hundreds of pages long. We’re trying our best to address it but confidence is shaky.

Q: Is Tunisia headed for inflation?

Unfortunately, we’ve reached inflation rates we never expected. At 6 percent we’re not the worst in the world, but these are the worst rates we’ve seen in Tunisia since the 1970s. Inflation reached 6.5 percent, but in the last few months we started to see a decline. In August rates dropped below 6 percent and the trend is declining. But it’s worrisome, because we’re not used to it and there are calls for increasing wages. We have problems, there is no doubt about that.