Media ID: 55385026

Caption:

Media ID: 55381022

Caption:

Media ID: 55379988

Caption:

Media ID: 55352377

Caption:

Media ID: 55379411

Caption:

Caption:

Caption:

A Japanese flag flies atop the Bank of Japan building in Tokyo (Reuters)

Japan Concerned over Low Inflation

Japan is the graveyard of economic theories. The country has had ultralow interest rates and run huge government deficits for decades, with no sign of the inflation that many economists assume would be the natural result. Now, after years of trying almost every trick...Caption:

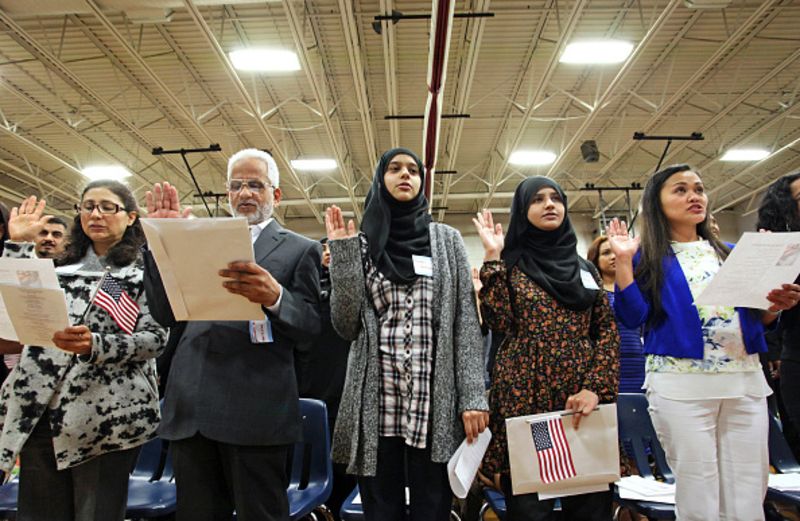

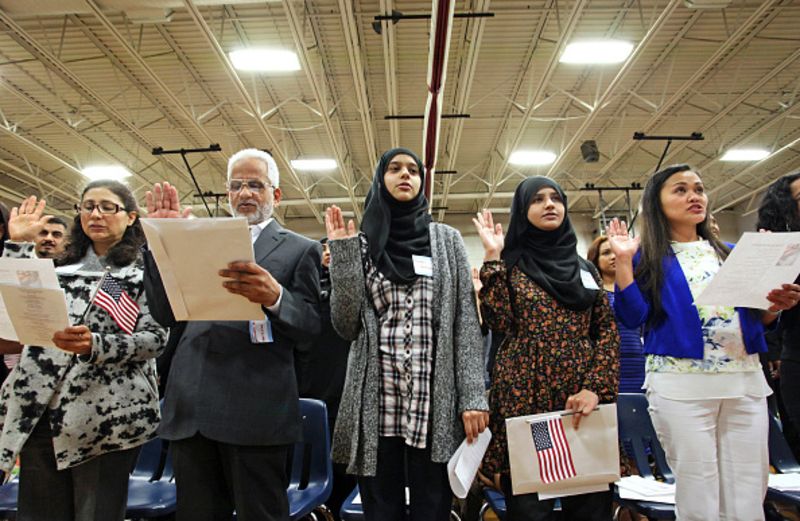

They’re Americans too. Photographer: Jill Brady/Portland Press Herald/Getty Images

Middle Eastern Immigrants Make the US Stronger

A little more than one week ago, Stanford University mathematician Maryam Mirzakhani died at the age of 40 after a battle with breast cancer. In that short lifetime, she accomplished more than most of us ever will. Mirzakhani was one of the world’s greatest...Caption:

A Lebanese banker counts US dollars at BLOM Bank’s head office in Beirut October 22, 2008. REUTERS/Jamal Saidi

Be Clear-Eyed About Democracy’s Weaknesses

In her new book, “Democracy in Chains: The Deep History of the Radical Right’s Stealth Plan for America,” Nancy MacLean writes that my Bloomberg View colleague Tyler Cowen, by questioning American political institutions, was creating “a handbook…for how to...Caption:

Too close for comfort. Photographer: Tim Graham/Getty Images