Media ID: 55385654

Caption:

Media ID: 55385581

Caption:

Media ID: 55385572

Caption:

Media ID: 55385564

Caption:

Media ID: 55385559

Caption:

Media ID: 55385476

Caption:

Caption:

Caption:

Prince Badr bin Farhan with Ghassan al-Shibl, Rashid al-Owain and Islam Zween (Asharq Al-Awsat)

Saudi Research and Marketing Group Acquires Controlling Stake in ‘Argaam’

Riyadh– As part of its plan to expand its range of specialized content and develop digital publishing initiatives, Saudi Research and Marketing Group (SRMG) acquired a controlling stake in the Argaam Investment and Trading Company. Argaam is a financial news portal...Caption:

Traders work on the floor of the New York Stock Exchange near the Goldman Sachs stall. (Reuters)

Oil Edges Higher on Gains as Geopolitical Threats Intensify in Kirkuk, Iran

London – As a number of geopolitical problems unfold, oil prices maintained gains on Tuesday, while Goldman Sachs said oil production from Iraq’s Kurdistan region was likely to be jeopardized by the standoff with Iraq. Despite the fears of the Kurdistan...Caption:

Future Investment Initiative announcement poster.

Speakers Controlling $22 Trillion in Asset Value Expected at Saudi Future Investment Initiative

Riyadh – Saudi Arabia’s Public Investment Fund (PIF), one of the world’s most important sovereign wealth funds, said that prominent speakers from the investment sector have confirmed tat they will be attending the “Future Investment Initiative.” Held in...Caption:

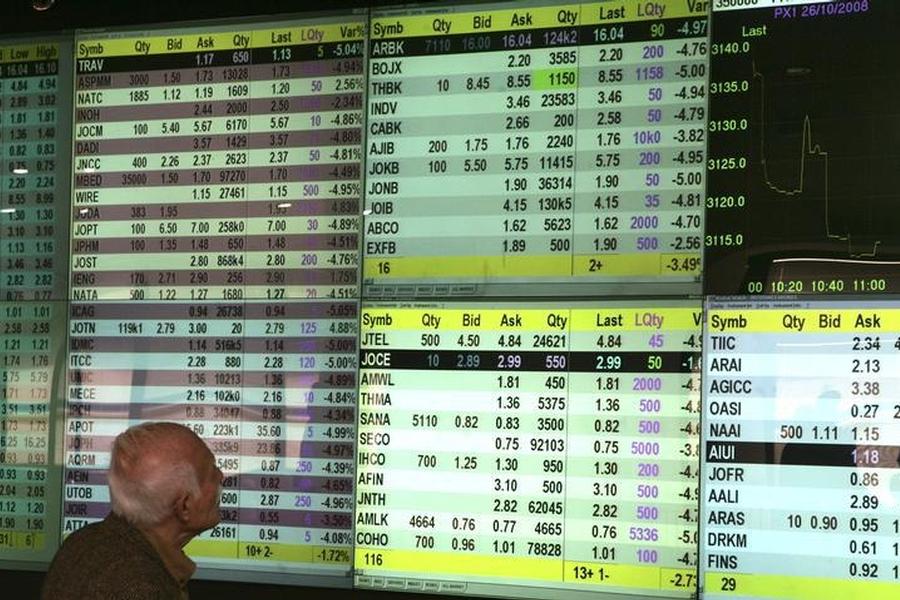

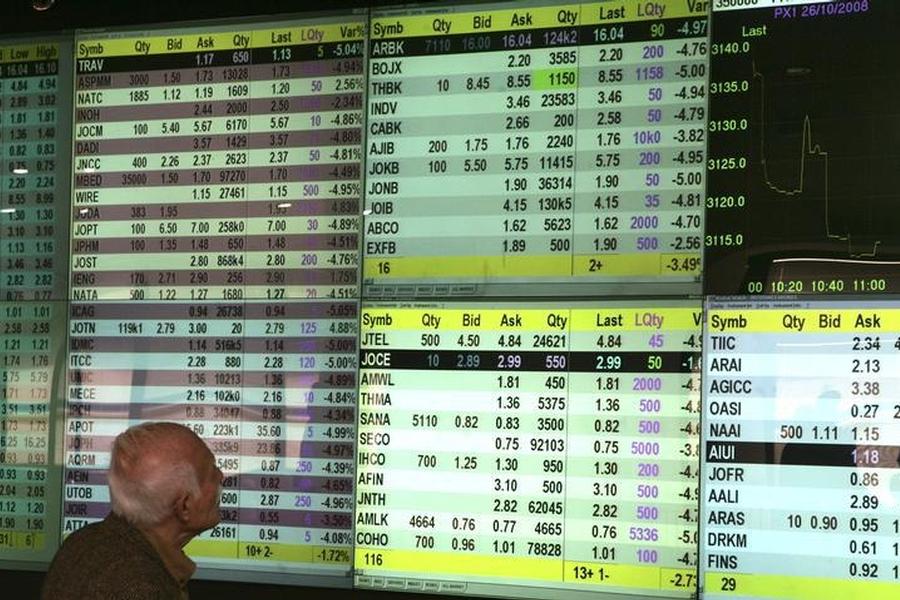

A trader looks at electronic displays at the Amman Stock Exchange. (Reuters)

Money and Investment Conference in Jordan Discusses Status of Digital Currencies

Amman – The 12th Money and Investment Conference got underway on Tuesday in Amman with the participation of Arab and foreign experts and international companies. The conference, titled “Digital coins [bitcoins] and their influence on the economy”, discussed the...Caption:

The National Bank of Kuwait’s Studies and Research Unit confirmed a decline in yields on Gulf sovereign bonds in parallel with a decline in risks and a rise in oil prices. (Getty Images)