Italy is ready to pump capital into Monte dei Paschi di Siena if the ailing bank fails to get the 5 billion euros ($5.3 billion) it needs to remain in business from private investors, a Treasury source said on Monday.Executives at Monte dei Paschi di Siena (MPS) are fighting to salvage a multibillion-euro rescue by private investors in a frantic attempt to prop up the bank.

Executives at MPS are fighting to salvage a multibillion-euro rescue by private investors in a frantic attempt to prop up the bank.

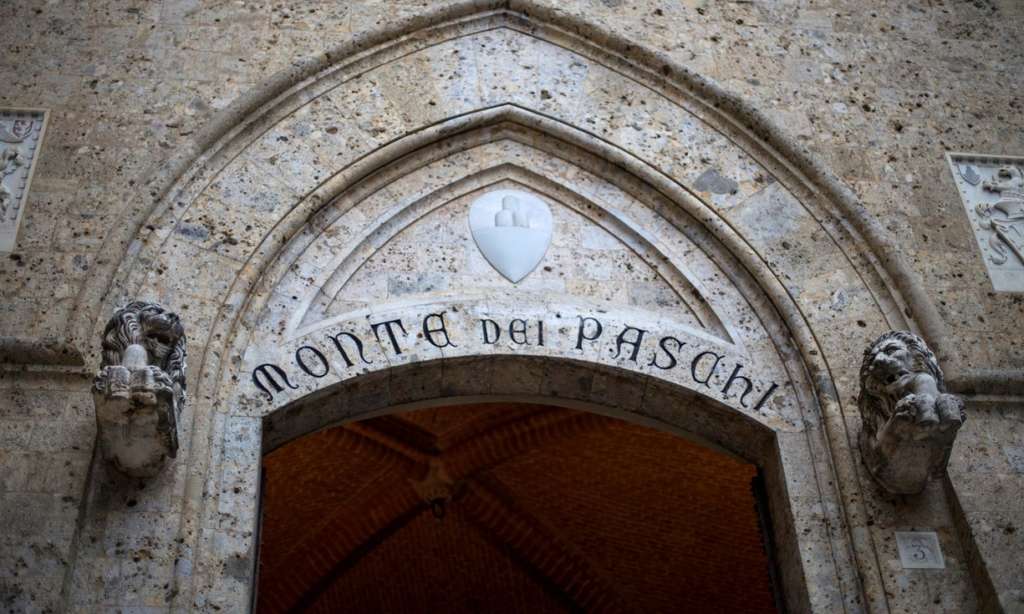

Italy’s third-biggest bank is pressing ahead with a last-ditch attempt to raise the cash on the market this year despite a government crisis triggered by Prime Minister Matteo Renzi’s resignation following his defeat in a Dec. 4 constitutional referendum.In a statement released after a board meeting on Sunday, the world’s oldest bank said it would forge ahead with a debt-for-equity swap offer for tens of thousands of retail investors. The offer still requires regulatory approval. If MPS manages to convince investors to go along with the plan, it would help it avoid a government bailout by Italy, which would have far-reaching economic and political consequences.

However, its chances of success are slim and the state is likely to have to step in to make up for the shortfall, bankers say.

A failure of the world’s oldest bank would threaten the savings of thousands of Italians and could have repercussions on Italy’s wider banking sector, which is saddled with 360 billion euros of bad loans – a third of the euro zone’s total.

“If the operation failed, the state would carry out a precautionary recapitalization,” the Treasury source said. “The bank’s existence and its clients’ savings will be preserved under any circumstances.”

However, the source said that any injection of public money would involve the mandatory conversion of subordinated bonds into shares, including for 40,000 retail investors, in line with European rules for dealing with bank crises.

The government, well aware of the unpopularity of such a move, is looking at ways to compensate ordinary Italians who invested their savings in the bank’s junior debt.

Monte dei Paschi shares rose 4 percent in afternoon trading, with traders saying the prospect that the state might act as an investor of last resort was helping the stock.