Copper prices rose to two-week highs on Wednesday as growing expectations the U.S. Federal Reserve will hold U.S. interest rates steady kept the dollar under pressure, but worries about Chinese demand limited gains.

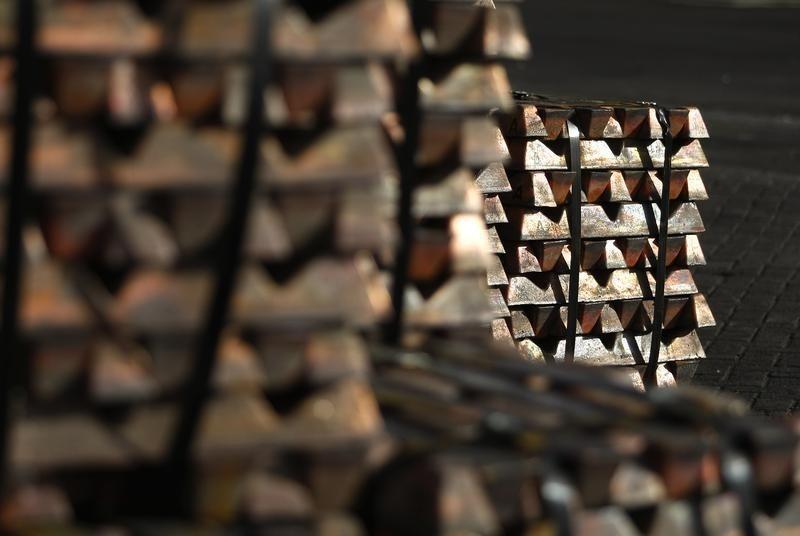

Benchmark copper on the London Metal Exchange was up 1.2 percent to $4,675 a tonne at 1000 GMT from an earlier high at $4,688.50, its highest since Aug. 24.

According to what Reuters wrote, a lower U.S. currency makes dollar-denominated commodities cheaper for non-U.S. firms, a relationship funds use to generate buy and sell signals.

Data showing activity in the U.S. service sector slowed to a 6-1/2 year low in August on Tuesday reinforced expectations the Fed would not move at its Sept. 20-21 meeting.

“It’s all to do with the dollar at the moment,” said SP Angel analyst John Meyer. “China is starting to tighten up again on liquidity, reduce lending.”

China is the world’s top consumer of industrial metals. Strong lending in the first half of the year boosted investment and output, but July data showed a drop to 463.6 billion Yuan from 1.38 trillion in June.

Metals markets are looking ahead to China’s trade data due on Thursday for clues to growth and demand prospects.

Elsewhere, three-month tin was up 0.3 percent at $19,580. It hit a 19-month high of $19,670 hit on Tuesday on worries about shortages and falling stocks in LME warehouses, which at 4,390 tones account for less than five days’ global demand.

Zinc gained 0.7 percent to $2,338 a ton. It is up more than 60 percent since the January lows on worries about shortages due to mine closures.

Nyrstar hedging its zinc output has fed some doubts about whether the rally can be sustained if producers ramp up output, particularly in China.

But analysts say falling treatment charges – fees paid by miners to smelters to process raw material into metal – towards $100 a tonne from above $250 in April 2015 suggest otherwise.

ICBC Standard Bank analyst Leon Westgate said the treatment charges indicate that zinc concentrates have been “destocked with bullish connotations for the market”.

Aluminium gained 0.3 percent to $1,594 a ton, lead added 0.1 percent to $1,948 and nickel rose 1.1 percent to $10,220.