LONDON – BoE stated last week that Britain risked several economic falls from lower growth, higher inflation and even recession incase voters supported a Brexit on June 23, which lead to criticism that the BoE was biased and somehow destabilizing markets.

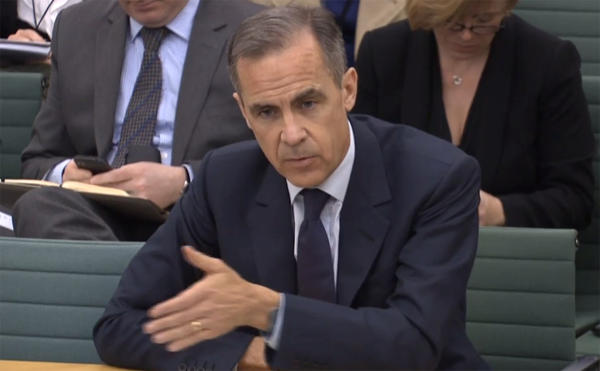

On the matter, Bank of England Governor Mark Carney denied comprising the central bank’s independence by warning of the short-run costs of leaving the EU, stating during a BBC interview that he did not overstep the mark, stressing that he would be failing the public if he didn’t flag dangers and outcomes in advance.

“We … have a responsibility to explain risks and then take steps, because by explaining them – by explaining what we would do to mitigate (them) – we reduce them. And that is the key point, ignoring a risk is not to reduce it” the latter said.

Polls show public opinion to be evenly divided, while Prime Minister David Cameron and the leaders of Britain’s other main political parties, as well as international bodies such as the IMF, all support Britain staying in the EU.

However on the other hand many Conservative lawmakers and party members want to leave, one of them, Jacob Rees-Mogg, member of the parliamentary committee which scrutinizes the BoE, stated again his view that Carney was no longer the right person to lead the central bank after last week’s comments.

“He should be fired, absolutely,” he told broadcaster ITV. “We now cannot trust the Governor of the Bank of England to set interest rates for anything other than the benefit of the government.”

Carney said the BoE’s job of ensuring financial stability and steering inflation back to its 2 percent target required it to be frank about short-term economic risks, such as a vote to leave the EU, that could hamper achieving these goals. And assured his confidence in British households to have the ability to service their debts incase interest rates needed to rise.

He added that he thought it “highly, highly unlikely” that the BoE would cut interest rates below zero if the economy slowed sharply, an option some of his colleagues on the BoE’s Monetary Policy Committee have said they are open to, however last week Carney said it was not clear if the BoE would need to cut rates, or to raise them, if Britain voted to leave the EU.